Qualitative vs Quantitative Research: Why You Need Both

Most people agree on one thing. Better decisions come from better information. Where teams struggle is deciding what kind of information actually matters.

Some people default to numbers. They rely on dashboards, surveys, conversion rates, and market size estimates. Others rely on conversations. They talk to customers, read feedback, and trust experience and instinct. Both approaches feel reasonable. Both are incomplete on their own.

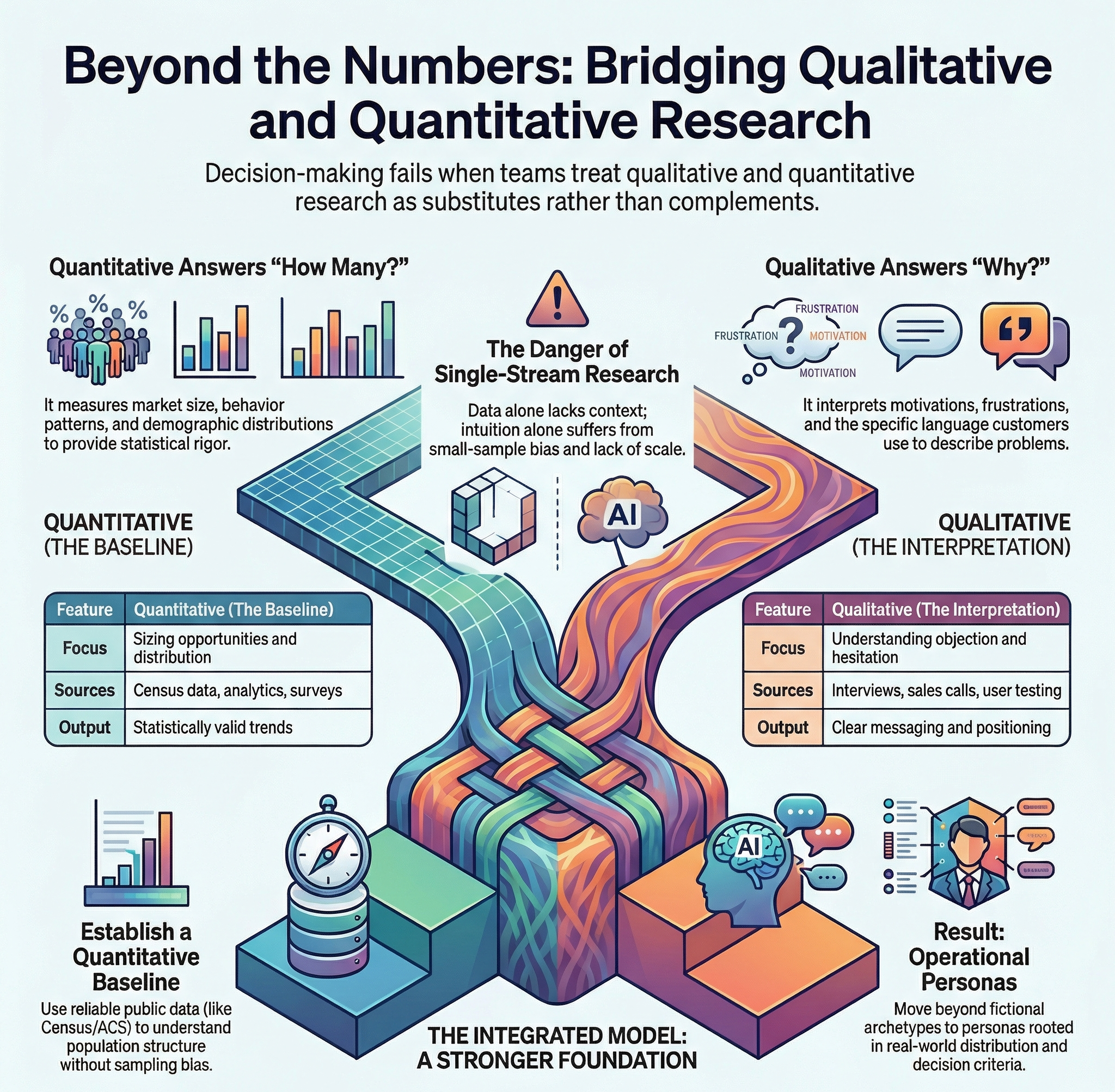

The real problem is not choosing the wrong input. It is treating qualitative and quantitative research as substitutes instead of complements. When teams rely on only one, they make decisions that look justified on paper but fail in the market, or decisions that feel right but do not scale.

This post explains why qualitative and quantitative research answer different questions, why relying on only one creates blind spots, and how combining public data sources like Census data with conversational AI creates a more reliable foundation for go-to-market strategy, product decisions, and messaging.

The Two Default Modes Founders Fall Into

Most early teams fall into one of two patterns.

The first is intuition-driven decision-making. You talk to a handful of customers, notice recurring themes, and move quickly. This approach values speed and proximity to the customer, but it often overweights a small sample of opinions.

The second is data-driven decision-making. Teams rely on metrics, surveys, and analytics to guide every choice. This approach values rigor and scale, but it often strips away context and delays action.

Neither approach is inherently wrong. The problem is assuming either one is sufficient.

Where Intuition Breaks Down

Customer conversations are essential. They reveal frustrations, motivations, and language that no dashboard can capture. But conversations alone introduce bias.

We tend to talk to early adopters, vocal users, or people already interested in the product. These users are not representative of the broader market. Their needs and behaviors often differ from those of later buyers.

Without quantitative context, teams risk:

-

Overbuilding for edge cases

-

Overestimating demand

-

Mistaking enthusiasm for willingness to pay

-

Generalizing from a small, non-representative group

Intuition is strongest when it is grounded in data that shows how common a problem actually is.

Where Data Alone Fails

Quantitative data scales well. It shows how many people behave a certain way and how trends change over time. But it rarely explains motivation.

Metrics can tell you:

-

Where users drop off

-

Which segments convert better

-

How large a market might be

They do not tell you:

-

Why users hesitate

-

What alternatives they are comparing you to

-

What language actually resonates

-

What tradeoffs they are making

Teams that rely only on data often optimize numbers without understanding behavior. This leads to superficial improvements that do not compound.

What Qualitative and Quantitative Research Actually Answer

A useful way to think about this distinction is by looking at the questions each method is designed to answer.

Quantitative Research Answers Scale and Distribution

Quantitative research is about measurement. It tells you how many people fit a profile, how common a behavior is, and how variables relate to each other.

Examples include:

-

Market size estimates

-

Demographic breakdowns

-

Survey results

-

Funnel metrics

-

Usage analytics

This type of research is critical for:

-

Sizing opportunities

-

Prioritizing segments

-

Allocating resources

-

Avoiding anecdotal decision-making

Public data sources like Census and ACS data are especially valuable here because they provide statistically valid views of populations across geography, income, education, and household structure.

Qualitative Research Answers Motivation and Meaning

Qualitative research is about interpretation. It explains how people think, what they care about, and how they describe their own problems.

Examples include:

-

Customer interviews

-

Open-ended survey responses

-

Sales call transcripts

-

Support conversations

-

User testing feedback

This type of research is critical for:

-

Message clarity

-

Product positioning

-

Feature prioritization

-

Understanding objections and hesitation

Qualitative insights are what turn abstract segments into understandable people.

Why Treating Them Separately Creates Problems

Many teams alternate between these methods instead of integrating them.

They start with numbers to identify a segment. Then they talk to a few users and build based on those conversations. Or they start with interviews, then try to justify decisions with data after the fact.

This separation creates several issues.

First, assumptions go untested. Qualitative insights feel compelling, so teams skip validating how widespread they are.

Second, data gets misinterpreted. Quantitative patterns lack context, so teams infer motivations that are incorrect.

Third, strategy becomes brittle. Decisions are either too generic to resonate or too specific to scale.

The result is wasted effort, slow iteration, and unclear positioning.

A More Reliable Model: Quantitative Baseline, Qualitative Interpretation

A more effective approach is to connect these methods deliberately.

Start with quantitative data to understand who exists, where they are, and how common certain conditions or behaviors are.

Then use qualitative insight to interpret what those patterns mean in practice.

This approach does two things at once:

-

It prevents overgeneralizing from small samples

-

It prevents misreading numbers without context

Using Census Data as a Quantitative Foundation

Public datasets like the U.S. Census and American Community Survey data provide a strong baseline for understanding markets.

They help answer questions like:

-

How many people fit a given demographic profile?

-

Where are they concentrated geographically?

-

What income and education levels are common?

-

How household structure varies by region

This data is slow-moving, reliable, and representative. It is not subject to the sampling bias that plagues most research.

Using it early helps teams avoid building strategies for markets that are too small, too fragmented, or economically misaligned with their offering.

Layering Conversational Insight on Top

Once you understand the population at a structural level, the next step is interpretation.

This is where conversational AI becomes useful.

Instead of treating qualitative research as a manual, slow process, conversational systems allow teams to:

-

Explore data through natural language

-

Generate hypotheses about motivation

-

Simulate how different segments might respond to messaging

-

Stress test assumptions before committing resources

The key is not automation for its own sake. It is speed and coverage.

Conversational interfaces allow teams to ask better questions earlier and iterate on understanding without waiting weeks for interviews or surveys.

Building Personas That Are Grounded and Useful

Personas often fail because they lean too heavily in one direction.

Some are purely demographic and read like Census tables. Others are purely narrative and read like fiction.

When quantitative data and conversational insight are combined, personas become operational tools instead of artifacts.

Effective personas:

-

Reflect real population distributions

-

Capture meaningful differences between segments

-

Include constraints like income, time, and risk tolerance

-

Use language customers actually use

-

Explain decision criteria, not just preferences

These personas support better decisions across marketing, product, and sales because they are rooted in reality and explain behavior.

How This Changes Go To Market Strategy

When teams integrate these methods, several things change.

Messaging becomes clearer because it is informed by both scale and motivation.

Channels are chosen more effectively because demographic data narrows focus before experimentation begins.

Product decisions improve because qualitative insights explain why certain features matter to specific segments.

Most importantly, teams waste less time debating opinions. Decisions are framed as testable hypotheses grounded in data and interpretation.

The Core Insight

Quantitative research tells you what is true at scale. Qualitative research tells you why it matters.

Treating one as superior to the other leads to incomplete strategies. Combining them creates a feedback loop where data informs conversation and conversation sharpens interpretation.

Public data provides a shared foundation. Conversational systems make that data usable. Together, they allow small teams to make decisions with the rigor that used to require large research budgets.

That is the real shift. Strategy becomes less about guesswork and more about structured understanding, without slowing teams down.

If you want to explore how these principles can be applied using real-world public data and interactive personas, you can start a free trial of Cambium AI here.

.gif)

.png)