Why Demographic Data Is Not Enough for Understanding Your Customers

If you are a founder or small business owner, you have almost certainly defined your target customer by age at some point. It is usually one of the first filters applied when trying to make sense of analytics dashboards, ad targeting options, or investor questions. “Our core customer is 35 to 45” sounds responsible and concrete.

Yet many teams discover that even with clear demographic targeting, their marketing does not convert as expected. Messaging feels generic. Campaign performance is inconsistent. Product decisions rely on intuition instead of confidence. The problem is not a lack of data. The problem is relying on the wrong kind of data.

Age alone does not explain behavior. It does not explain motivation. It does not explain why someone chooses oner or why they delay a purchase they clearly need. Research on psychographic segmentation shows that traits such as values, attitudes, and motivations often explain consumer behavior more effectively than demographic attributes like age or income.

To build an effective strategy, you need to understand how people experience their day, what pressures shape their decisions, and what problems they are actively trying to reduce.

That is where daily stressors matter.

The Common but Incomplete Approach

Most early-stage companies begin their customer understanding with demographics because they are accessible and familiar. Analytics tools surface them automatically. Ad platforms require them. Market reports organize audiences around them.

The typical process looks like this:

-

Identify an age range that seems most likely to buy

-

Add a few additional traits, such as income band or job role

-

Write messaging intended to appeal broadly to that group

-

Launch campaigns and iterate based on performance metrics

This approach feels logical. It is structured. It creates a sense of progress. But it stops short of answering the most important questions.

Two people who are both 40 years old may share almost nothing in common when it comes to priorities, constraints, and decision-making. One may be managing a team of twenty while caring for young children. Another may be self-employed, focused on maintaining cash flow, and working unpredictable hours. Their age tells you very little about what they need from a product or how they evaluate risk.

Empirical consumer research comparing demographic and psychographic variables finds that psychographic factors consistently outperform demographics when predicting product preference and response.

Demographics describe a population. They do not explain behavior.

Why Demographics Fail to Drive Real Decisions

Marketing and product decisions fail when they are built on assumptions instead of context. Age-based segmentation encourages assumptions because it implies shared needs that often do not exist.

Here are the most common failure points.

Generic Messaging

When messaging is written for a broad age range, it avoids specificity by necessity. It focuses on surface benefits instead of concrete problems. As a result, it sounds interchangeable with competitors. Customers may understand what you offer, but they do not feel that it was built for them.

Marketing analysis shows that segmentation strategies relying only on demographics often produce generic messaging because they lack insight into customer motivations and decision context.

Specificity requires understanding what people struggle with, not just how old they are.

Poor Conversion Efficiency

Campaigns that target demographics without context often attract attention but fail to convert. Click-through rates may look acceptable, but downstream metrics reveal hesitation. Prospects do not move forward because the message does not align with the problem they are actively trying to solve.

Conversion improves when people recognize their situation in the message.

Unclear Product Direction

When teams lack insight into customer stressors, product development becomes reactive. Features are added based on requests from the loudest users or internal opinions. Over time, the product grows more complex without becoming more useful.

A clear understanding of daily challenges helps teams prioritize what actually reduces friction for customers.

What Daily Stressors Actually Reveal

Daily stressors are the recurring pressures that shape how people allocate time, money, and attention. They are not abstract emotions. They are practical constraints and ongoing frustrations.

Examples include:

-

Lack of time to evaluate new tools

-

Fear of making the wrong purchase decision

-

Pressure to justify spending to others

-

Overload from managing too many responsibilities

-

Anxiety about consistency, reliability, or outcomes

These stressors influence how people buy far more than demographic traits do. They explain why someone chooses a familiar solution over a better one. They explain why price sensitivity varies within the same income bracket. They explain why some users want simplicity while others want control.

Studies in consumer behavior research demonstrate that stress directly affects spending decisions, shifting how people evaluate risk, urgency, and necessity.

When you understand stressors, you understand tradeoffs.

Moving From Description to Explanation

Demographics describe who your customer is. Stressors explain why they behave the way they do.

This distinction matters because strategy depends on explanation, not description. To make good decisions, you need to know:

-

What problem feels urgent right now

-

What risks feel unacceptable

-

What outcomes justify change

-

What constraints limit action

Age does not answer these questions. Context does.

A 42-year-old buyer under pressure to deliver results quickly evaluates products differently than a 42-year-old buyer optimizing for long-term efficiency. Without understanding that difference, marketing messages and product positioning remain unfocused.

A Better Way to Build Customer Understanding

Improving your strategy does not require abandoning demographics. It requires treating them as a starting point rather than a conclusion.

A more effective approach combines three layers of insight:

-

Demographics to define the population

-

Behavioral data to observe actions

-

Qualitative insight to understand motivation

Daily stressors sit at the center of this model because they connect behavior to intent.

Step One: Identify Repeating Pressures

Start by identifying pressures that recur across your audience. These are not one-time complaints. They are patterns.

You can uncover them through:

-

Customer interviews focused on workflow and decisions

-

Open-ended survey questions about challenges

-

Support conversations and sales calls

-

Public reviews of competing products

The goal is not to collect opinions. The goal is to understand constraints.

Ask questions such as:

-

What makes this problem hard to solve today

-

What happens if nothing changes

-

What would success look like in practical terms

These questions surface stressors that influence behavior.

Step Two: Connect Stressors to Decisions

Once you understand common pressures, map them to the decisions customers make.

For example:

-

Time pressure leads to a preference for fast setup

-

Accountability pressure leads to demand for reporting

-

Financial pressure leads to cautious trial behavior

This step turns insight into a usable strategy. It explains why certain features matter and why others are ignored.

Step Three: Reflect Stressors in Messaging

Effective messaging acknowledges pressure directly. It does not exaggerate it or dramatize it. It demonstrates understanding.

Instead of claiming broad benefits, describe situations your customer recognizes. Show how your solution fits into their existing constraints rather than asking them to change behavior first.

This builds trust because it signals relevance.

Step Four: Inform Product and Prioritization

Daily stressors should guide roadmap decisions. When tradeoffs arise, prioritize changes that reduce friction under pressure.

Ask:

-

Does this make the customer’s day easier or harder

-

Does this reduce risk or add complexity

-

Does this save time where it actually matters

Products that respect customer constraints earn long-term adoption.

Why This Approach Scales Better

Founders often assume that a deeper understanding of customers slows growth. In practice, the opposite is true.

When strategy is grounded in real pressures:

-

Messaging becomes clearer and more consistent

-

Sales cycles shorten because objections are anticipated

-

Product decisions align with actual usage

-

Acquisition becomes more efficient

This reduces wasted effort. Teams spend less time guessing and more time executing with confidence.

Importantly, this approach also scales across segments. While stressors vary, the method of identifying and addressing them remains consistent. That makes it repeatable as your audience grows.

The Role of Data in Making This Practical

Understanding stressors does not require anecdotal thinking. It requires a structured analysis of qualitative and quantitative signals.

Public data sources, behavioral analytics, and structured qualitative research can all contribute. The key is synthesis. Numbers alone do not explain motivation, but they can validate patterns. Conversations alone do not scale, but they can reveal what metrics miss.

When these inputs are combined, strategy becomes evidence-based rather than assumption-driven.

Conclusion:

Knowing your customer’s age range is not the same as understanding how they make decisions. Age does not reveal pressure, constraints, or tradeoffs. Daily stressors do. When strategy is built around those pressures, marketing becomes more relevant, product decisions become clearer, and growth becomes more predictable.

The challenge for most founders is not recognizing the value of this insight. It is accessing it quickly, affordably, and with enough rigor to trust it. Traditional research methods are slow and expensive, which often pushes teams back toward assumptions and surface-level data.

Today, it is possible to ground customer understanding in real public data and test ideas against realistic behavioral models before committing time and budget. Synthetic personas enable the exploration of customer stressors, motivations, and decision-making patterns without the need for weeks of waiting for interviews or surveys.

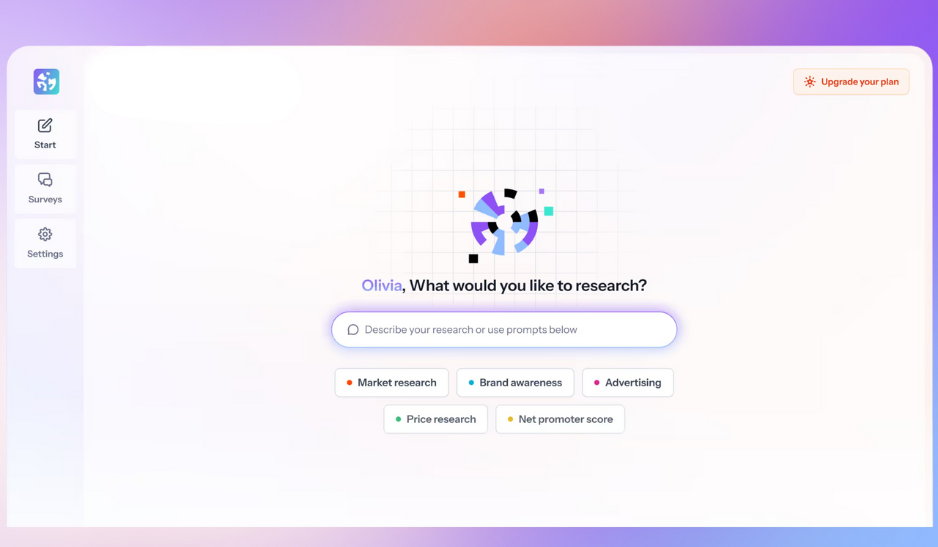

If you want to see how this kind of research-driven, context-aware approach works in practice, platforms like Cambium AI make it possible to generate statistically grounded personas and test messaging, positioning, and ideas through direct conversation with them.

.png)

.png)